has capital gains tax increase in 2021

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. Hundred dollar bills with the words Tax Hikes getty.

The current capital gain tax rate for wealthy investors is 20.

. Get more tips here. Implications for business owners. For income tax years commencing on or after July 1 1995 a modification in the form of a reduction of income taxable by the state of Colorado shall be allowed to any qualified taxpayer.

Ad Tip 40 could help you better understand your retirement income taxes. Connect With a Fidelity Advisor Today. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

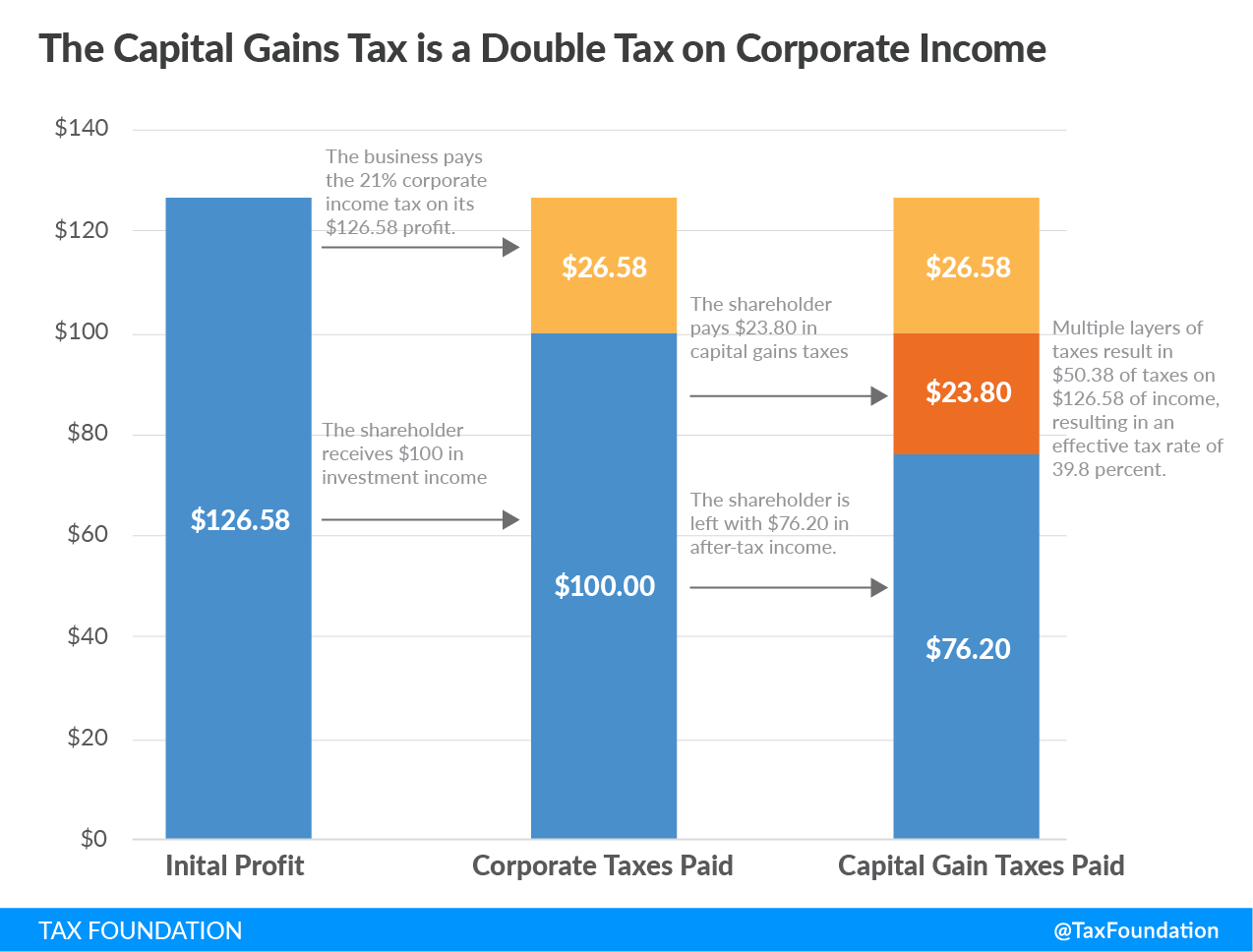

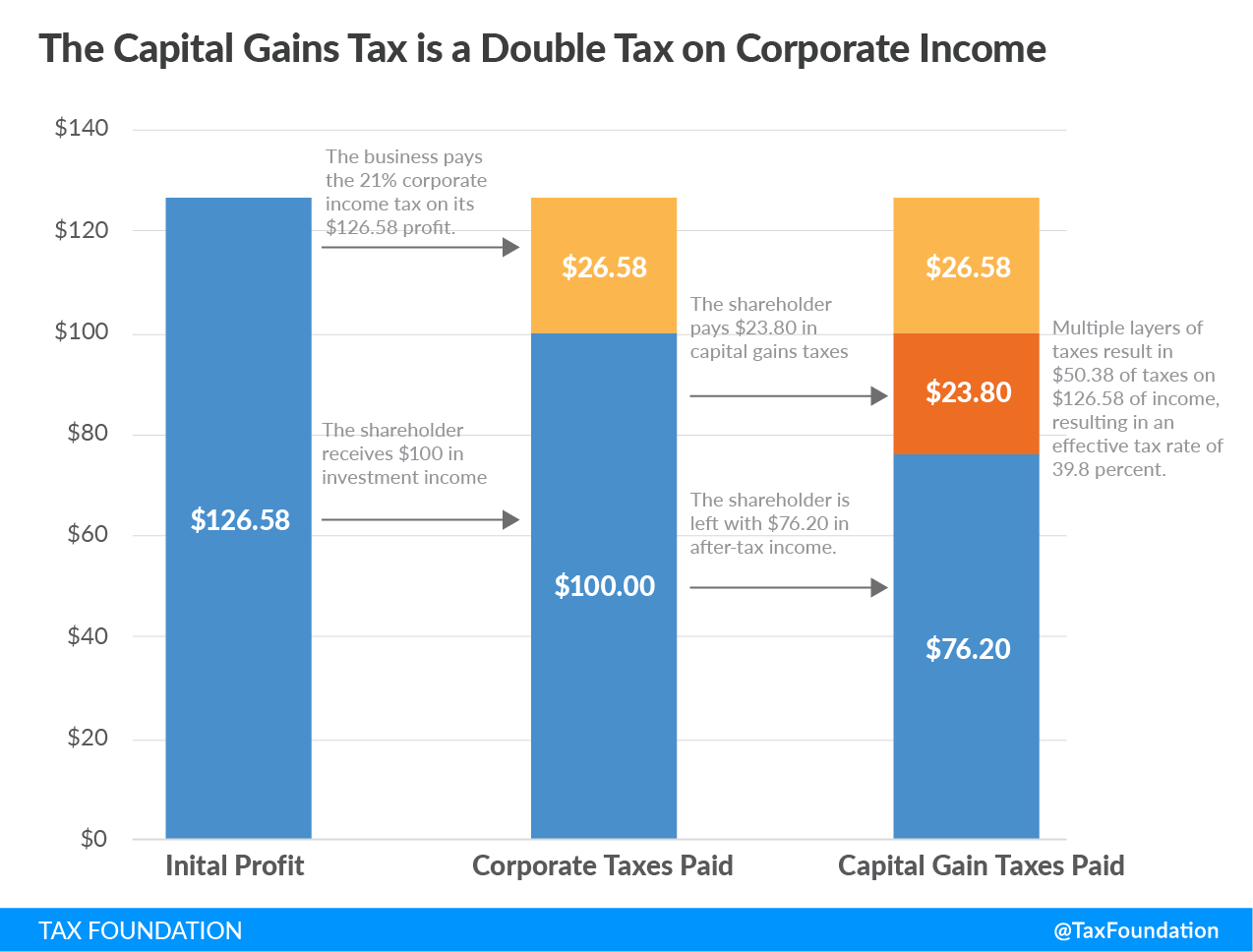

Many speculate that he will increase the rates of capital. Under the current rules a 100000 long-term capital gain would face a 23800 tax bill at the federal level. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The 238 rate may go to 434 for some. History is a good indicator of the impact of a capital gains increase on. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

Unlike the long-term capital gains tax rate there is no 0. With the proposed rates under the Biden tax plan the taxes on this. In the highest capital gains tax bracket those earning 1 million or more on an annual basis¹ both short and long-term capital gains would be taxed as ordinary income.

Download 99 Retirement Tips from Fisher Investments. The Chancellor will announce the next Budget on 3 March 2021. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

When the NIIT is added in this rate jumps to 434. Posted on January 7 2021 by Michael Smart. Long-term capital gains are taxed at their own long-term capital gains rates which are less than most ordinary tax rates.

Capital Gains Tax Rates 2021 To 2022. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. Here are 10 things to know.

Based on filing status and taxable income long-term capital gains. Long-Term Capital Gains Taxes. The long-term capital gains tax rate is either 0 15 or.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model.

Its time to increase taxes on capital gains. To address wealth inequality and to improve functioning of our tax. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

That rate hike amounts to a staggering 82. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Biden Budget Biden Tax Increases Details Analysis

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Double Taxation Definition Taxedu Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Tax Income Taxes In Canada Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Difference Between Income Tax And Capital Gains Tax Difference Between

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)